Doctors of chiropractic strive to guide their patients to the best possible health outcomes. It’s an occupation dedicated to helping others overcome physical challenges and achieve a higher quality of life as a result.

It’s also a business, and the more streamlined a practice is run, the easier the goal of helping people can be achieved. In other words, the more successful your practice, the more patients you can help. That’s why every chiropractic doctor investing in computer-assisted adjustment tools should know about the 179 tax deduction.

What is the 179 Deduction?

Small and mid-size businesses can take advantage of certain tax deductions that allow them to grow and thrive. If you are attempting to expand your chiropractic practice in one way or another—the number of services you offer and patients you can see a day, for example—exploiting these incentives is crucial.

The 179 deduction is one of the most potent tax deductions for chiropractors and small to medium-sized practices. Despite being a powerful tool, only 27% of chiropractors that participated in a recent survey reported previously using the deduction. Of the remaining chiropractors, a whopping 38% were certain that they had never used the deduction.

This is noteworthy because the 179 deduction can play an integral role in growing a practice in a significant way. This IRS tax code allows businesses “to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year.”

If you’re not quite sure what that means or why it matters, you’ll want to read on.

Why the 179 Deduction Matters

Consider the 179 deduction a way to save a substantial amount of money on equipment that is integral to your practice, its success, and its future. While we’re not tax experts, this particular deduction is a stellar way for chiropractors to invest in themselves and in their practice at a discount. It’s basically an incentive from the government to grow your business and improve the economy as a result.

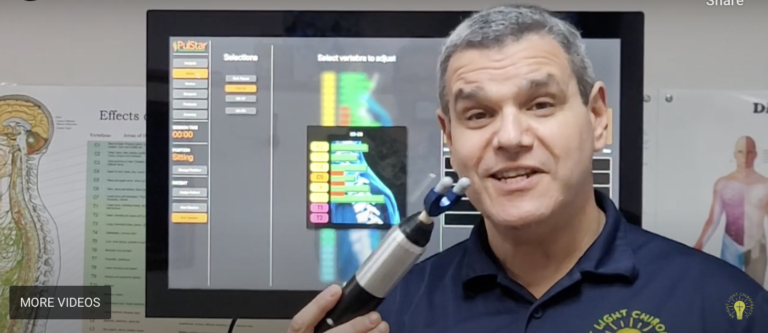

Essentially, the 179 deduction permits you to deduct the entire purchase price of certain equipment from your gross income. The list of qualifying items is pretty long, and they must meet specific criteria. Thankfully, chiropractic tools like the PulStar qualify for this deduction, giving your practice an opportunity to expand and take advantage of this deduction.

We recommend checking out section 179 for yourself and speaking to an expert on the matter. Both resources will help you make an informed decision regarding the 179 deduction and how it can benefit your practice.

To give you an idea of just how effective section 179 can be for chiropractors, consider the following example. If you spend one million dollars on equipment in a given tax year, you can deduct one million of that purchase. You can then take a 100% depreciation. In the end, that one million worth of chiropractic equipment will cost $650,000. That’s a savings of 35%!

Due to the lack of awareness among chiropractors who participated in the survey, education on how chiropractors can invest in themselves and save money with section 179 is essential. That’s why Sense Technology – PulStar is committed to helping you grow your practice by taking full advantage of every break possible, including the 179 deduction.

If you would like to learn more about the 179 deduction and your chiropractic practice, feel free to reach out to us. Our team is passionate about helping you provide your patients with the best possible service, and that starts with helping your practice reach its full potential.