The Art and Mastery of Instrument Adjusting: A Chiropractor’s Journey

In a recent Facebook post, Dr. Korsen shares his journey of transitioning to a PulStar Precision Spinal Adjuster practice, reflecting on the hesitations, challenges, and,

Fill out this form to receive regular expert tips in your inbox!

In a recent Facebook post, Dr. Korsen shares his journey of transitioning to a PulStar Precision Spinal Adjuster practice, reflecting on the hesitations, challenges, and,

In the dynamic landscape of healthcare, chiropractic care stands out as a holistic approach to wellness, focusing on the relationship between the body’s structure and

The ways in which instrument adjusting has changed the chiropractic world cannot be understated. Any doctor of chiropractic that has learned and utilized adjustment instruments

Lower back pain is one of the most common ailments in America, with approximately 30% of adults reporting that they suffer from the condition. Not

In the realm of chiropractic care, technology continually paves the way for groundbreaking methods that significantly enhance patient outcomes. The PulStar system has transformed practices

More than three million cases of sciatica are reported yearly. You probably already see a lot of sciatica patients in a week, but there are

Essential Elements Lotion FAQ We are very excited about our Essential Elements Lotion. You may have noticed that the more excited we get, the more

“PulStar Treatment In 45 Cases of Supraspinatus Tendon Calcification,” conducted by researchers at the Benxi First People’s Hospital in China, was published in the Journal

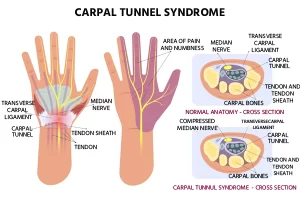

Carpal Tunnel Syndrome (CTS) can be a debilitating condition affecting both patients and healthcare professionals. Finding effective treatment methods that provide relief to patients while